What Are Investment Risks?

Investing helps your money grow, but it’s not always easy. I remember buying my first stock. I thought I made a great choice. But a few months later, the stock dropped fast. That’s when I learned that knowing the risks is just as important as picking the right investments.

Table of Contents

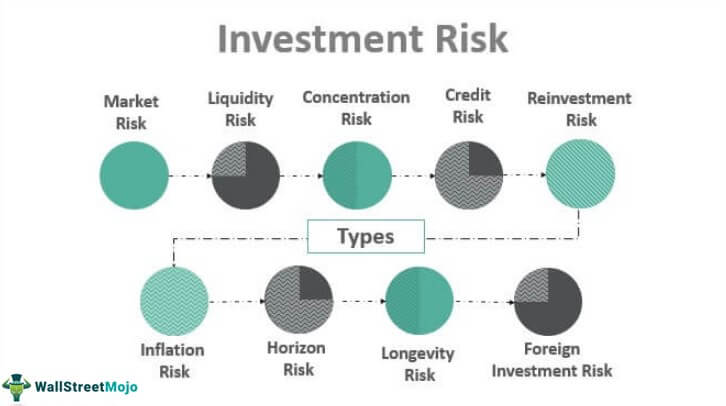

ToggleUnderstanding Investment Risks

Investment risks mean you could lose money. This happens because of market changes, economic shifts, or company problems. If you’ve ever seen your portfolio drop overnight, you know how unpredictable investing can be.

Here are some common risks:

- Market Risk: Investments lose value when markets change.

- Credit Risk: A borrower doesn’t repay their debt.

- Liquidity Risk: You can’t sell your investment fast without losing money.

- Inflation Risk: Prices rise, making your money worth less.

- Interest Rate Risk: Changing interest rates affect investments.

How to Manage Investment Risks

You can’t avoid risk, but you can prepare for it. I once put all my money into one risky stock. Big mistake! I lost a lot and learned a tough lesson. Now, I spread my investments to lower risk.

Here are smart ways to manage investment risks:

| Strategy | What It Means | Why It Helps |

|---|---|---|

| Diversification | Invest in different things | One bad investment won’t hurt much |

| Asset Allocation | Adjust investments to match your risk level | Keeps your portfolio stable |

| Regular Monitoring | Check investments often | Helps you make smart moves |

| Use of Tools | Use tools like HypeIndex AI | Get alerts and insights fast |

Common Investment Risks and How to Handle Them

Every investment has risks, but knowing them helps you stay ahead. Let’s go over the big ones.

Market Risk: Prices Go Up and Down

Market risk affects all investors. Stocks, bonds, and other assets rise and fall. I remember watching my portfolio drop during a market crash. It was stressful! That’s when I learned how helpful tools like HypeIndex AI can be. They spot early trends so you can act fast.

Credit Risk: Borrowers Might Not Pay Back

Credit risk happens when someone doesn’t repay a loan. This affects bonds and loans. If you’ve ever lent money to a friend and never got it back, you know how it feels. Checking credit scores and debt levels can help avoid this risk.

| Factor | Why It Matters |

|---|---|

| Credit Score | Shows if a borrower is reliable |

| Debt-to-Income Ratio | Measures if they can afford more debt |

Liquidity Risk: Hard to Sell Investments

Liquidity risk means you can’t sell an investment fast without losing money. It’s like having a rare item that no one wants to buy right away. To avoid this, choose investments that you can sell quickly.

Inflation Risk: Prices Keep Rising

Inflation risk means your money might buy less in the future. I once met a retired investor who saw his savings lose value over time. Keeping an eye on inflation and investing in different assets can help.

Interest Rate Risk: Rates Change, Investments React

Interest rate changes affect bonds and real estate. Watching trends and adjusting your investments can help reduce the impact.

Political and Economic Risk: Events Affect Markets

Government policies, economic shifts, and world events can shake up markets. The 2008 financial crisis and recent global events show how fast things can change. Staying informed and using smart tools can help manage these risks.

What to Watch:

- Government rules

- Economic changes

- Global markets

Investing is all about balance—knowing risks, managing them, and using the right tools. If I’ve learned anything, it’s that being prepared makes all the difference!

Easy Ways to Lower Investment Risks

Investing can be risky. I learned this when I put most of my savings into a tech stock, thinking it would go up. But after a few months, the stock crashed. That’s when I knew I needed a better plan. Luckily, there are simple ways to protect your money. Let’s go over them.

Diversify: Don’t Put All Your Money in One Place

Diversification means spreading your money across different investments. If you put all your money into one stock and it drops, you lose a lot. But if you invest in different areas like stocks, bonds, and real estate, one bad investment won’t hurt as much.

Here’s what I do:

- Invest in different industries like tech, healthcare, and finance.

- Buy some international stocks to reduce risk.

- Mix safe and risky investments.

One of my stocks dropped, but my other investments helped balance the loss.

Asset Allocation: Find the Right Mix

Asset allocation is about spreading your money wisely. Younger people can take more risks, while older investors may prefer safer options.

| Age | Risk Level | Investment Mix |

|---|---|---|

| 20-35 | High | 70% Stocks, 20% Bonds, 10% Cash |

| 36-50 | Medium | 60% Stocks, 30% Bonds, 10% Cash |

| 51+ | Low | 50% Stocks, 40% Bonds, 10% Cash |

At first, I took too many risks. Changing my investments made my portfolio more stable.

Hedging: Protect Your Money

Hedging is like having a safety net for your investments. It helps you avoid big losses.

- Options limit your losses.

- Futures contracts lock in prices.

- Derivatives help manage risk.

At first, I didn’t understand hedging. But after learning and getting advice, I saw how useful it is.

Check Your Investments Often

Markets change, so your investments should too. Checking them regularly helps you catch problems early.

- Review your investments monthly, quarterly, or yearly.

- See which ones are doing well and which aren’t.

- Adjust them to keep your balance right.

I once held onto a bad stock for too long. Now, I check my portfolio often to make better choices.

:max_bytes(150000):strip_icc()/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)

Tools for Safer Investing

Using the right tools makes investing easier and less risky.

Risk Checkers: Know Your Risk Level

Understanding your risk level is important. These tools help:

- Risk Surveys: Show how much risk is right for you.

- Simulators: Let you see how investments might perform.

- Portfolio Analyzers: Check risks and suggest changes.

Get Advice From Experts

A financial expert can help you make better choices. They can:

- Help diversify your investments to reduce risk.

- Check your portfolio regularly to keep it balanced.

- Give market insights so you stay informed.

I used to invest based on gut feelings. Getting expert advice made my decisions smarter.

Keep Learning About Investing

The more you learn, the better your choices. Some great resources:

- Online courses on investing.

- Webinars and workshops from experts.

- Books and articles from trusted sources.

- Investment blogs for market updates.

The more I learn, the smarter I invest.

Real-Life Risk Management

How AI Helps Reduce Risks

A great tool for managing risk is HypeIndex AI. It uses smart technology to track market trends and alert investors.

| Feature | Benefit |

|---|---|

| AI Analysis | Tracks market trends |

| Real-Time Alerts | Warns about market changes |

| Quick Reports | Creates summaries in 30 seconds |

| Sentiment Score | Ranks investments by hype |

| News Scraping | Collects data from different sources |

| Unlimited Access | Gives unlimited reports |

Using tools like this helps investors avoid risks and make smarter choices.

Lessons From Bad Investments

Ignoring market trends is a big mistake. I once held onto a stock even when bad news came out, thinking past success meant future gains. I was wrong. Here’s what I learned:

- Ignoring Market Trends can lead to losses.

- Relying Too Much on Past Data can be risky.

- Not Checking Risks can cost you money.

Now, I use AI tools to stay informed and avoid mistakes.

Balancing Risk and Reward

All investments have risks. Bigger rewards usually mean bigger risks. Finding the right balance is key.

How Different Investments Compare

Each type of investment has a different risk level:

- Low-risk: Savings accounts, government bonds.

- Medium-risk: Mutual funds, index funds.

- High-risk: Stocks, cryptocurrencies.

When I started, I wanted fast profits. Now, I focus on balance to protect my money.

Setting Realistic Investment Goals

Before you start investing, it’s important to set clear and realistic goals. Think about your future and ask yourself these three key questions:

- What is your investment timeline?

- How much risk can you handle?

- What are your financial goals?

These questions are key for making smart investment choices. When I started, I wasn’t sure how much risk I could take. But once I figured out my timeline and goals, it was easier to pick the right strategy.

Here are some types of goals to think about:

| Type | Example |

|---|---|

| Short-term | Buying a car |

| Medium-term | Saving for a down payment on a house |

| Long-term | Saving for retirement |

Setting goals helps you stay focused and make better decisions. For example, when I saved for my home, I used a strategy that balanced risk and growth. It kept me on track and helped me stay calm when the market changed.

Long-term Vs Short-term Investments: Weighing The Risks

Long-term investments usually have less risk because you have time to ride out market ups and downs. Think about retirement accounts or real estate. The longer you invest, the more you can grow your wealth through compound interest. I’ve seen the power of compound growth in my retirement savings over time.

Short-term investments are riskier, but they can offer faster returns. These might include day trading or short-term bonds. I’ve tried short-term trades, and while they can bring quick profits, they can also be stressful. This is something to think about if you need cash fast.

Understanding the risks of both types of investments is important for choosing the right strategy. I use tools like HypeIndex AI to track market movements, which helps me make smart decisions with both long-term and short-term investments.

Conclusion: Navigating Uncertainty For Maximized Returns

Investing comes with risks, but managing them well can lead to higher returns over time. Here are some important tips:

Key Points Recap:

- Risk Assessment: Always evaluate risks before you start. It’s like checking the weather before a hike—you need to know what to expect.

- Diversification: Spread your investments across different assets to reduce risk. I do this to avoid putting all my money in one place.

- Market Analysis: Stay updated on market trends. I use tools like HypeIndex AI for real-time alerts to stay ahead.

- Emotional Control: Don’t panic when markets go up and down. Stick to your plan.

- Professional Advice: Don’t hesitate to ask for help from financial experts. I’ve done it when I needed advice.

Final Thoughts On Risk Management

To manage risk and get the most from your investments, here are some tips that have worked for me:

- Stay Informed: Tools like HypeIndex AI help me make smart decisions during market changes.

- Set Clear Goals: Know your goals and how much risk you can handle. Once I set clear goals, everything else fell into place.

- Regular Monitoring: Check your investments often. I review mine monthly and adjust as needed.

- Be Patient: Investing is a long-term game. I used to get frustrated with slow growth, but now I’m happy I stuck with it.

By using these strategies, you can manage uncertainty and aim for the best returns. The key is being informed and making choices that match your financial goals.

Frequently Asked Questions

What Are Investment Risks?

Investment risks include market risk, credit risk, liquidity risk, and inflation risk. I’ve faced these, especially market risk when the market dropped right after I made a big investment. It was a wake-up call, but it taught me the value of diversification.

How Do I Manage Investment Risks?

Spread your investments across different assets. I balance my investments in stocks, real estate, and bonds to lower risk. Review and adjust them regularly.

Why Is Diversification Important?

Diversification protects you. I learned this when one of my early investments lost value. Spreading my money helped minimize the loss.

How Does Inflation Risk Affect Investments?

Inflation lowers the value of your returns. I noticed this with bonds—when inflation rises, the returns don’t go as far. Keep this in mind for long-term planning.

Conclusion

Understanding investment risks is important. Stay informed and take action based on your goals. Tools like HypeIndex AI have helped me stay ahead of market changes. Knowledge is your best defense against risks. Stay educated, stay prepared, and you’ll be on track to meet your financial goals.