Finance Management Software: Managing Money Can Be Easy for Small Businesses

Handling money can feel tricky. I’ve seen business owners struggle with spreadsheets, lost invoices, and tax stress. But when they used smart finance tools like Financial Fusion, things got much easier. It connects to accounting apps and gives real-time updates, making money management simple.

I helped a friend start an online shop, and tracking expenses by hand was tough. But after switching to a tool that worked with Shopify and QuickBooks, his reports made sense, and his stress disappeared. Want to see how Financial Fusion can help you too? Let’s check it out!

Table of Contents

ToggleWhat Is Small Business Finance Software?

Managing business money can be overwhelming—I’ve been there! That’s why Financial Fusion is a smart pick. It connects with accounting apps and provides real-time insights. Let’s explore why this software is important and how it can help your business grow.

Why It’s Important

Finance software isn’t just about numbers—it helps you make smart decisions. Financial Fusion uses AI to break down data and give easy-to-understand insights. It works with QuickBooks, Xero, Zoho, Airtable, Excel, and Shopify, so your records stay updated.

I worked with a small bakery that used paper logs. They were always behind on numbers. When they got finance software with custom reports and AI insights, they quickly found where they were overspending. In a few months, they adjusted their budget and made more profit.

With custom reports, businesses get clear financial insights for better planning. Since it connects with accounting systems, it saves time and reduces mistakes.

How It Helps Your Business

Using Financial Fusion makes running a business easier. Here’s why:

✅ Smarter Choices: AI tools give live insights for better decisions.

✅ Saves Time: No more manual tracking—everything syncs automatically.

✅ Clear Reports: Custom reports highlight key trends.

| License Tier | Price | Features |

|---|---|---|

| Tier 1 | $29 | Basic reports for 1 company |

| Tier 2 | $99 | Full reports, balance sheets, and yearly reviews for 1 company |

| Tier 3 | $199 | Full reports, balance sheets, and yearly reviews for up to 5 companies |

Financial Fusion also has a 60-day money-back guarantee, so you can try it risk-free. I know trying new software can feel like a big step, but this makes it easy. Plus, the lifetime access option is a great deal!

Top Features of Finance Software

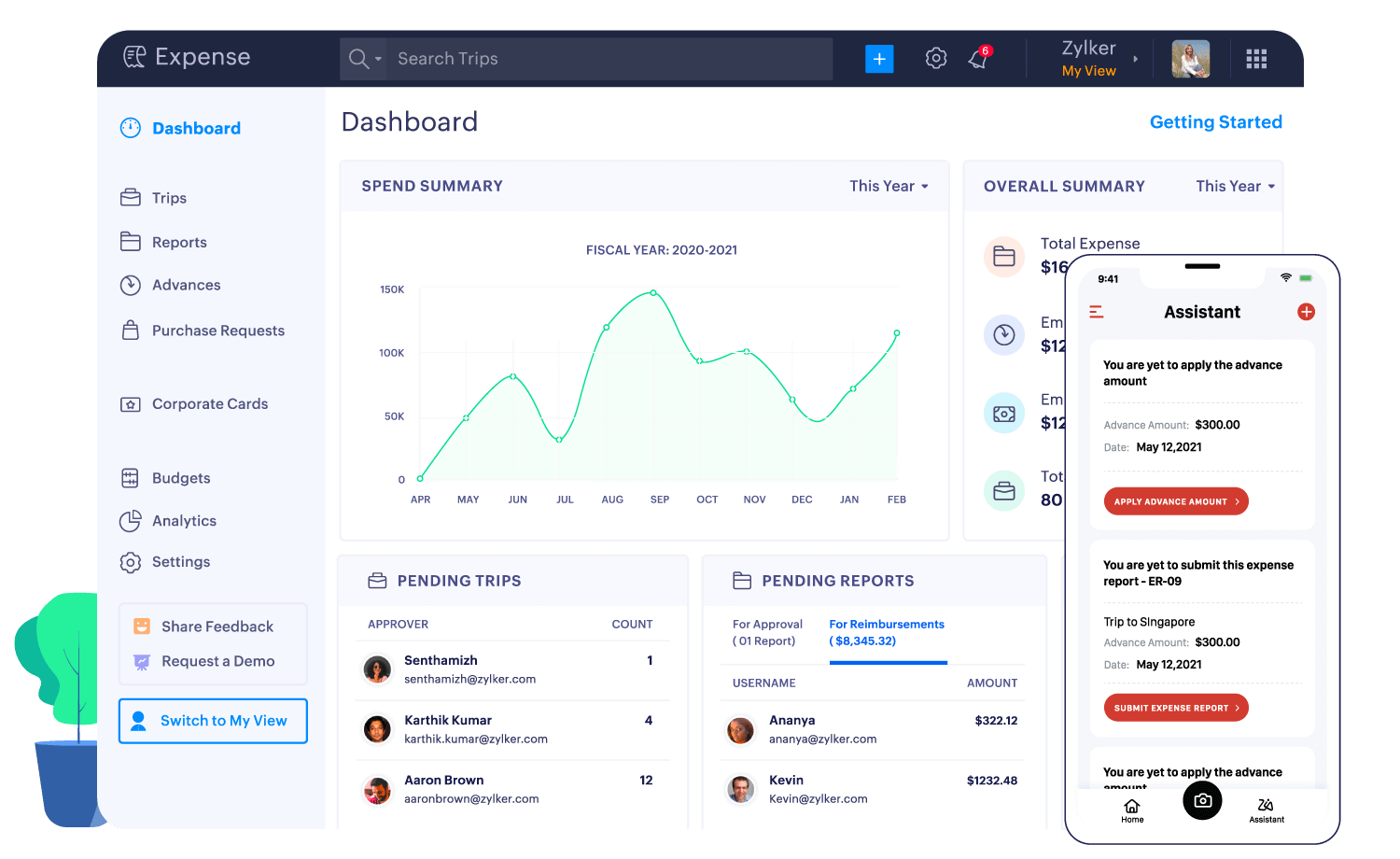

Good finance software saves time, cuts mistakes, and gives helpful insights. Financial Fusion is easy to use and powered by AI. Here are some of its best features:

Automated Bookkeeping

No more typing in numbers! Financial Fusion automates bookkeeping to reduce errors and improve accuracy. It links with QuickBooks, Xero, and Zoho, so financial data updates on its own.

I once saw a business owner spend hours entering invoices, only to find errors later. With automation, those mistakes disappeared, and he saved a lot of time.

Simple Expense Tracking

Tracking expenses is easy with Financial Fusion. It syncs with accounting apps and categorizes transactions automatically. This helps businesses see where their money goes and cut unnecessary costs.

Easy Invoicing & Billing

Late payments can hurt a business. Financial Fusion lets you send invoices and set payment reminders, making sure money comes in on time.

Clear Financial Reports

Understanding finances is key to success. Financial Fusion creates custom reports that break down important financial trends. The AI-powered insights help businesses make smart money choices.

Tax Help & Compliance

Tax season doesn’t have to be hard. Financial Fusion helps businesses stay tax-compliant by keeping financial records accurate and updated. This reduces tax errors and makes filing much easier.

| License Tier | Price | Features |

|---|---|---|

| Tier 1 | $29 | Basic reports for 1 company |

| Tier 2 | $99 | Full reports, balance sheets, and yearly reviews for 1 company |

| Tier 3 | $199 | Full reports, balance sheets, and yearly reviews for up to 5 companies |

With a 60-day money-back guarantee, you can try it for two months with no risk. I’ve seen businesses use this tool and get better control over their finances—and I know it can help you too!

Pricing And Affordability Made Simple

Finding the right finance software for your small business doesn’t have to be hard. You need something that’s affordable and useful. Let’s break down Financial Fusion’s pricing so you can pick the best fit for you.

Pricing Plans

Financial Fusion has three pricing tiers to match different needs. Here’s a quick look:

| Plan | Price | What’s Included |

|---|---|---|

| Tier 1 | $29 | One-time purchase, lifetime access, basic month-end report, profit and loss for 1 company |

| Tier 2 | $99 | One-time purchase, lifetime access, detailed reports, profit and loss, balance sheet, quarterly and yearly reviews for 1 company |

| Tier 3 | $199 | One-time purchase, lifetime access, detailed reports, profit and loss, balance sheet, quarterly and yearly reviews for up to 5 companies |

What You Get With Each Plan

✔️ Tier 1 – A simple option to track finances. You get a month-end report and a profit and loss statement for one company.

✔️ Tier 2 – Need more details? This plan includes a balance sheet and quarterly reviews. Business owners who switched from messy spreadsheets love how this makes tax time easier!

✔️ Tier 3 – Have more than one business? This plan lets you track up to five companies. A bakery owner I know saved hours of work by using this plan!

How Financial Fusion Compares

How does it compare to other options? Let’s take a look:

| Software | Cost | What’s Included |

|---|---|---|

| Financial Fusion (Tier 1) | $29 | Basic report, profit and loss for 1 company |

| Financial Fusion (Tier 2) | $99 | Detailed reports, profit and loss, balance sheet, reviews for 1 company |

| Financial Fusion (Tier 3) | $199 | All Tier 2 features for up to 5 companies |

| Competitor A | $50/month | Basic financial tracking, limited reports |

| Competitor B | $100/month | Advanced reports, supports multiple companies |

Why do people love Financial Fusion? It’s a one-time payment. No monthly fees!

Pros And Cons Of Finance Software

✅ Pros: Saves Time, Cuts Errors, And Makes Life Easier

- Automates bookkeeping by syncing with QuickBooks, Xero, and Shopify. No more manual data entry!

- AI-powered insights show exactly where your money goes—no more guessing.

- A café owner I know switched to software and quickly spotted where he was losing money. His profits went up in just a few months!

❌ Cons: Takes Time To Learn And Has An Upfront Cost

- New software can feel confusing at first. But once you get used to it, it’s a huge time-saver.

- The upfront cost is lower than paying monthly, but it still feels like a big expense. That said, most users save money fast just by avoiding mistakes.

Final Thoughts

| Plan | Price | What’s Included |

|---|---|---|

| Tier 1 | $29 | Basic report, profit and loss for 1 company |

| Tier 2 | $99 | Detailed reports, profit and loss, balance sheet, quarterly and yearly reviews for 1 company |

| Tier 3 | $199 | All Tier 2 features for up to 5 companies |

The right finance software saves time, stress, and money. If you want to take control of your business finances, Financial Fusion is a smart choice!

Who Should Use Financial Fusion?

Choosing the right financial software can make a big difference for small businesses. The right tool can save you time and make managing finances easier. Financial Fusion is built for different types of businesses. Here’s who it’s great for:

Perfect for New Businesses or Startups

When you’re just starting, you don’t want complicated tools. I helped a friend who ran an online store. She struggled with tracking money by hand. After switching to Financial Fusion, she got clear, simple reports without the hassle.

Financial Fusion uses AI to help new businesses understand their finances. It also connects with QuickBooks, Xero, and Zoho, so you can sync your data easily.

💡 Best Plan: License Tier 1 ($29 one-time payment). This plan gives you a simple month-end report and a profit and loss statement for one company—perfect for keeping things easy and affordable.

Best for Growing Businesses with More Complex Finances

As your business grows, tracking finances by hand can become impossible. I’ve worked with business owners who outgrew spreadsheets and needed detailed reports to make smart decisions. One client told me switching to automated reports saved him three hours a week, giving him more time for his business.

Financial Fusion helps you stay organized with custom reports and AI insights. You’ll get real-time updates and better control over your finances.

💡 Best Plan: License Tier 2 ($99 one-time payment). This plan includes detailed reports, profit and loss statements, balance sheets, and quarterly and yearly reviews for one company—everything you need as your business grows.

Great for Businesses Needing Strong Financial Oversight

If you run several businesses or need in-depth financial insights, Financial Fusion is a solid choice. I know a business owner who ran both a store and a service company. Managing two sets of finances was overwhelming—until she switched to a plan that helped her handle multiple businesses at once.

With AI-powered reports, easy integrations, and real-time updates, you’ll stay on top of everything.

💡 Best Plan: License Tier 3 ($199 one-time payment). This plan covers detailed reporting for up to five companies, so managing multiple businesses is simple.

Frequently Asked Questions

What is Small Business Finance Management Software?

It’s a tool that helps you track expenses, manage invoices, and handle accounting, so you can spend more time running your business.

How Does Finance Software Help Small Businesses?

It automates bookkeeping, reduces mistakes, saves time, and provides real-time financial insights to help you make better decisions. I’ve seen businesses go from messy, manual tracking to clear, easy-to-understand reports—and it made a huge difference.

Can Finance Software Connect with Other Tools?

Yes! Financial Fusion connects with QuickBooks, Xero, and other accounting tools, so your data flows smoothly.

Is Finance Software Secure?

Yes! Financial Fusion uses strong encryption and security measures to keep your data safe. It meets industry standards for protection.

Conclusion

Financial Fusion isn’t just finance software—it’s a smart, time-saving tool that helps you make better decisions. With AI-powered insights, real-time updates, and lifetime access, it’s a great investment.

If you want to save time, avoid mistakes, and take control of your finances, this is a great choice. Plus, there’s a 60-day money-back guarantee, so you can try it risk-free!.