Table of Contents

ToggleBest Tools for Small Business Billing: Billing Is Hard for Small Businesses

I get it—it’s slow and easy to mess up.

But good tools can help. Billing tools save time and stop mistakes. When I started freelancing, I made all my invoices by hand. It took so long! I spent more time on billing than real work. Then I found a billing tool. It changed everything. I got paid faster and saved hours.

If you run a small business, the right tool can help your cash flow. It also gives you more time to focus on your work.

In this post, I’ll share some of the best billing tools. They let you make custom invoices, send reminders, and more. One I like is Billed. It does invoices, estimates, tracks time, and keeps up with expenses. I use it for my clients. I like how easy it is to send repeat invoices and track hours.

Let’s see why billing tools aren’t just helpful—they’re a must. With Billed, you can stop stressing over bills and spend more time growing your business.

Intro: Easy Billing for Small Businesses

Money is key in business. But let’s be real—you’d rather help clients than chase payments. Billing tools make this easy. They help you send invoices, track costs, and get paid. In this guide, I’ll show you tools that save time and keep money flowing.

Why Good Billing Matters

Good billing keeps cash coming in. I once forgot to send an invoice. That late payment messed up my whole month.

Billing tools fix that. They stop errors, save time, and help you focus on your business.

Bad billing can also hurt trust. I once made a mistake on a client’s bill. It was awkward. Since then, I’ve used better tools. Now, my bills are clear and correct. It makes me look more professional.

What Billing Tools Do

Billing tools do more than send bills. They add up costs, track payments, and make reports. This saves time and gives you a better look at your money.

| Feature | What It Does | Why It Helps |

|---|---|---|

| Custom Invoices | Add notes and files to your invoices | Look pro and give clear info |

| Auto Math | Adds taxes and discounts for you | No mistakes, less effort |

| Repeat Invoices & Reminders | Sends bills and reminders again and again | Keeps money coming in |

| Online Payments | Lets clients pay different ways—even part payment | Makes it easy for them, faster for you |

| Time Tracking | Tracks time spent on jobs | Helps you bill right and stay fair |

| Expense Tracking | Snap photos of receipts and store notes | Keeps costs in order |

I use Billed because it does all this. I can send bills, track time, and keep costs in one place.

- Saves Time: Sends bills fast

- Stays Right: Math is done for you

- Works Your Way: Clients can pay how they like

- Boosts Output: Smart reports help you plan

- Use Anywhere: Works on all your devices

- Keeps It Clear: Easy to find what you need

Pick a tool that fits your style. It’ll make work easier and help your business grow.

Top Features to Look For

Want to stay on top of your money? A good billing tool helps you send smart invoices, track spending, and get paid faster.

Let’s talk about auto billing. I used to forget to send invoices. Now, I use Billed. It sends them for me. I just set it up once. The templates look great and let me add notes or even a spot to sign.

Keeping track of costs was also hard. I’d lose receipts all the time. Now, I just take a photo. Billed reads the receipt for me. It helps me know the real cost of every job—great for quotes.

Clients like it too. I can see their full history. If they ask something, I have the answers. That makes me look sharp and ready.

Getting paid is also easy. Billed works with PayPal, Stripe, Mollie, and Square. Clients say it’s fast and simple. Many even pay sooner now.

And the reports? Total win. I can see what I made and what I spent. That helps me set better rates and make smart choices.

Billing tools like Billed do more than send invoices. They save time, cut mistakes, and let you focus on what you love to do.

Automated Invoicing

If you’ve spent hours writing invoices by hand, I get it—I’ve done that too. But now, I use automated invoicing. It helps small businesses a lot. It makes billing simple, keeps track of money, and saves time. I use a tool called Billed. It helps me make clean invoices, send quotes, track spending, and log work hours. It has made my work so much easier.

How Automated Invoicing Saves Time

When I started out, I spent weekends writing bills and sending reminders. It took me away from my real work. Then I found Billed. Now I can set up repeat bills and reminders with a few clicks. The templates look good, and I can change the design. What once took hours now takes minutes. I can now spend more time helping my clients.

Reducing Errors With Automated Invoicing

I used to make small mistakes—wrong numbers, missing tax, and more. It made me look bad. Billed changed that. It does the math for me and adds tax and discounts. I also track time and spending as I work. So when I send a bill, it’s all set. This helps me avoid mistakes and keeps my clients happy.

Improving Cash Flow Management

I often got paid late. Sometimes I forgot to follow up, or my client forgot to pay. Billed helped fix that. It sends reminders and gives many ways for clients to pay. Many now pay faster. I also like the reports. They show where my money goes. That helps me make smart choices for my business.

| Feature | Description |

|---|---|

| Custom Invoices | Use templates, add notes, files, or a signature |

| Auto Math | Adds taxes and discounts for you |

| Repeat Bills & Reminders | Sends bills and reminders by itself |

| Online Payments | Clients can pay in full or part in many ways |

| Time Tracking | Tracks hours for each job |

| Expense Tracking | Take photos of receipts and log them |

Billed has made invoicing fast and easy. I use it every day to keep my business smooth and my clients happy.

Expense Tracking

Let’s be honest—tracking spending by hand is hard. I used to keep all my receipts in a drawer and hope I could find them later. But I never did. Now I use Billed. It saves me time, helps me make better money choices, and keeps everything in one place.

Monitoring Business Expenses Efficiently

I learned that the best way to track spending is to do it right away. With Billed, I log my costs as they happen. I add tax and take pictures of receipts with OCR. One time, I logged a lunch cost during a meeting. It took just two taps. It keeps everything neat and easy to find.

Categorizing Expenses For Better Budgeting

When I started sorting costs by job or client, I saw where my money really went. Billed makes this easy. I made my own labels and used reports to see the big picture. It helped me charge better prices and plan smarter for the future.

Benefits Of Real-time Expense Tracking

The best part? My numbers are always up to date. I don’t get surprises at tax time or the end of the month. One time, I caught a wrong charge on the same day it happened. I fixed it fast—and saved money.

| Feature | Benefit |

|---|---|

| OCR Receipt Scan | Takes photo and logs receipt right away |

| Clear Reports | Shows money info in a simple way |

| Real-Time Tracking | Lets you act fast with fresh info |

| Expense Labels | Helps plan and stick to your budget |

Billed made it easy to track and understand my spending. It helps me stay on budget and grow my business with less stress.

Customer Management

Good service keeps your business strong. When I started tracking client info and talking clearly, things got easier. Billed helps me stay on top of everything and keeps my clients happy.

Maintaining Customer Records

I used to keep client info in many places—spreadsheets, notes, and emails. Now it’s all in one place with Billed. I can see contact info, payment history, and old notes. One day, a client called with a question. I found the answer in seconds. That built trust fast.

Streamlining Communication With Clients

Billed makes me look pro without more work. I send clean bills, quick reminders, and fast quotes. One client told me my stuff looked “polished”—I won’t forget that. Having all chats in one spot also means no confusion.

Enhancing Customer Relationships

Small touches matter. I can add notes or extra fields to bills. Clients can pick how to pay. They can even log in and see their full history. That keeps things clear and easy. I’ve gotten more repeat work just by keeping it simple.

| Feature | Benefit |

|---|---|

| Client Info in One Place | Keeps all details safe and easy to find |

| Auto Reminders | Sends follow-ups so you don’t have to |

| Quick Quotes & Bills | Saves time and looks sharp |

| Personal Touches | Adds care to every invoice |

| Many Payment Options | Clients pick what works for them |

| Full History Access | Builds trust with full record |

Billed made client work smoother and more personal. It helps me give better service and grow my business.

Payment Processing Integration

Payment processing is key for small businesses. It makes billing easy. I learned how important it is to have a good system. I used to use many tools to handle payments, and it was messy! But once I used Billed, everything changed. Now, payments are fast, safe, and all done in one place. Here’s why that matters.

Seamless Integration With Payment Gateways

Entering payment details into different systems can take time. With Billed, you can connect to PayPal, Stripe, and Mollie. This was a game-changer for me. I no longer switch between platforms. The first time I set up PayPal with Billed, it took just minutes. Payments came in fast! Now, everything is in one place, and I save a lot of time.

Accepting Multiple Payment Methods

I learned that customers like to pay in different ways. At first, I only took credit card payments. But many clients asked for bank transfer or PayPal. Billed made it easy to offer these options. Now, I accept payments from digital wallets too. The more payment options you offer, the more likely you are to get paid on time.

Ensuring Secure Transactions

Security is always on my mind. I’ve seen how breaches can cause big problems. That’s why I trust Billed. It follows GDPR rules and keeps data safe with encryption. After linking PayPal and Stripe with Billed, I felt secure. Billed also has fraud protection, which gives me peace of mind.

Reporting and Analytics

It’s important for small business owners to understand their finances. I used to struggle with not knowing where my money was going. But now, Billed’s reports and analytics make it easy to track my income and expenses. Generating reports is fast and saves me time.

Generating Financial Reports

I used to hate manual calculations. When I started my business, I didn’t have a good tool to track money. Now, Billed makes it easy to create reports. I can add taxes, discounts, and payment terms to invoices, and Billed does the math. Once, I sent an invoice with Billed, and the client said it looked very professional and accurate.

Analyzing Business Performance

Billed isn’t just for invoices—it gives me a view of my business performance. I can track my time on projects and watch my expenses. This tracking helped me catch an extra cost and remove it right away. It feels great to control my money, not be surprised at the end of the month.

Making Data-driven Decisions

Using data to make decisions has helped my business grow. The reports from Billed show me trends and help me adjust. I use the analytics to see where my money goes, so I can make better choices. Recently, I noticed I was spending too much on tools, so I switched to cheaper options. This saved me money and made things simpler.

Pricing and Affordability

Choosing the right billing tool that fits your budget and needs is tough. I used to think cheap tools were best, but I learned that features matter more. After trying different tools, I chose Billed. It offers great features at a fair price.

Cost Comparison of Popular Billing Tools

| Tool | Price | Features |

|---|---|---|

| Billed | $49 (One-time payment) | Custom Invoices, Automated Calculations, Recurring Invoices, Time Tracking, Expense Tracking, Online Payments |

| Tool B | $15/month | Basic Invoicing, Expense Tracking, Payment Reminders |

| Tool C | $25/month | Advanced Invoicing, Time Tracking, Expense Reports |

I found that Billed’s one-time payment worked best for me. It gives me everything I need—custom invoices, automated math, and expense tracking—without monthly fees. When I compared it to other tools, I realized I was getting much more for less.

Evaluating Value for Money

When I started, I had a small budget and wasn’t sure about spending on tools. But after using Billed, I saw it was worth it. Automated invoices, time tracking, and keeping everything in one place saved me hours each week. Recurring invoices and reminders helped my cash flow stay steady. Billed saved me time and helped my business grow.

Choosing the Right Tool for Your Budget

When picking a billing tool, think about your needs and budget. If you’re starting out and don’t have a lot to spend, a monthly plan might work best. But if you need full features with a one-time payment, Billed is a great choice. I’ve used both types, but now I wouldn’t trade Billed for anything. It’s been a big help in running my business smoothly.

Pros and Cons of Popular Billing Tools

Choosing the right billing tool for your small business can be hard. There are many options, each with different features. But they also have some downsides. I know how confusing it can be to choose the right one. Let’s look at the pros and cons of some popular billing tools, so you can decide which is best for you.

Tool A: Strengths and Weaknesses

I’ve used Tool A. It has many features to help small businesses manage money.

Strengths:

- Easy to use: Setting it up was simple. The layout was clear, which was great since I’m not very techy.

- Works with payment gateways: I could easily link it to PayPal, Stripe, and other payment systems. This saved me a lot of time.

- Automated invoicing and reminders: It automatically sent out invoices and reminders, so I didn’t have to do it.

Weaknesses:

- Limited customization: While it’s easy to use, I couldn’t make the invoices look the way I wanted.

- No mobile app: It didn’t have a mobile app, which would have been helpful for managing things on the go.

- Expensive premium features: Some advanced features cost extra, and the price added up fast.

Tool B: Strengths and Weaknesses

I also tried Tool B. It’s another good option for small businesses.

Strengths:

- Detailed reports: The reports were easy to read and helped me make better business decisions.

- Multiple currencies: This tool works with many currencies, which is useful if you have international clients.

- Customizable invoices: I could change the templates to fit my business needs.

Weaknesses:

- Hard to set up: It took a lot of time to get started. It could be tricky for those who aren’t very tech-savvy.

- Limited customer support: When I needed help, it took a while to get assistance.

- Slow during busy times: The tool slowed down when there were lots of transactions happening.

Tool C: Strengths and Weaknesses

I’ve also used Tool C. It’s great for managing invoices, expenses, and time tracking.

Strengths:

- Customizable invoices and estimates: I could make the invoices look exactly the way I wanted.

- Automated tax and discount calculations: This saved me time, especially with complicated taxes.

- Multiple payment options: Customers could pay in many ways, which made it easier for me.

- Time and expense tracking: It was easy to track hours worked and expenses, which made invoicing quicker.

- Mobile and web access: I could use the tool on my phone or computer, no matter where I was.

Weaknesses:

- Takes time to learn: At first, the tool was hard to figure out.

- Limited free features: The free plan didn’t let me do enough.

- Occasional glitches: Sometimes, I ran into bugs, but the team fixed them quickly.

Each billing tool has its strengths and weaknesses. It’s important to pick the one that fits your business.

Recommendations for Ideal Users

Choosing the right billing tool is key to running a smooth business. I’ve found that different people need different features, so picking the right tool can really improve how things work.

Best Tools for Freelancers

As a freelancer, I found Billed to be a great choice. Here’s why:

- Custom invoices: I could create professional invoices with easy-to-use templates.

- Automated calculations: Taxes and discounts were automatically calculated, saving me time.

- Time tracking: I could track how much time I spent on each project, making billing easier.

- Expense tracking: I could track my expenses and add receipts.

- Online payments: Accepting payments was quick, and the option for partial payments helped my cash flow.

Best Tools for Small Businesses with Teams

For small businesses with teams, I recommend Billed because of these features:

- Recurring invoices and reminders: These helped me maintain cash flow by sending invoices and reminders automatically.

- Team collaboration: I could invite my team to log their hours and track expenses.

- Mobile and web apps: I could access the tool from my phone or computer, whether I was at the office or traveling.

- Detailed reports: The reports helped me stay organized and understand my finances.

- Flexible pricing: Billed has different pricing options, so I could choose what worked best for my team.

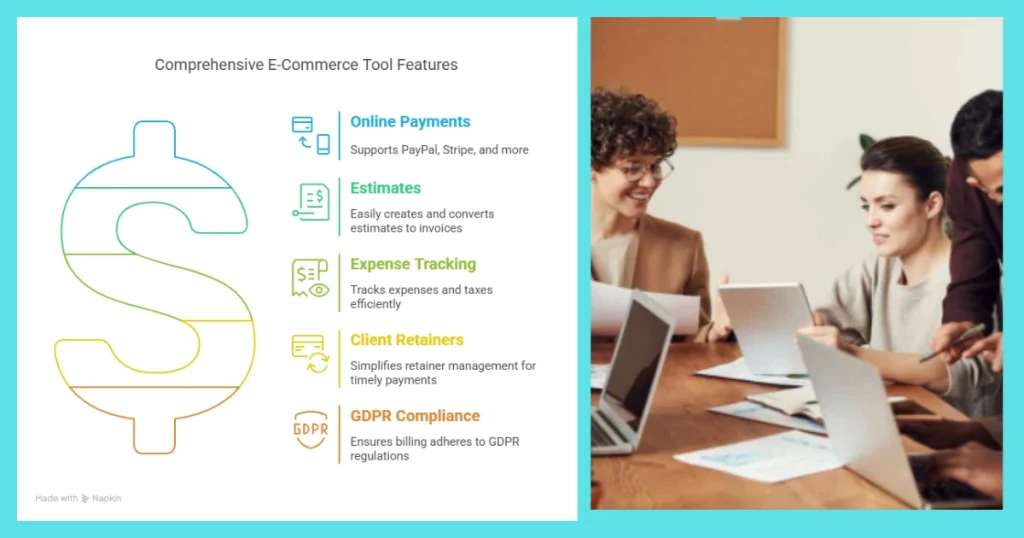

Best Tools for E-Commerce Businesses

For e-commerce, I think Billed is one of the best options. Here’s why:

- Online payments: It works with PayPal, Stripe, and more, which is essential for e-commerce.

- Estimates: I could create and turn estimates into invoices easily.

- Expense tracking: It helped me track all expenses and taxes.

- Client retainers: Managing retainers was easier, ensuring I got paid on time.

- GDPR compliance: Billed helps ensure your billing follows GDPR, which is important for businesses working with EU customers.

If you want a complete solution for your business finances, Billed is a great option.

Frequently Asked Questions

What Are the Best Billing Tools for Small Businesses?

Some of the best billing tools I’ve used are FreshBooks, QuickBooks, and Zoho Invoice. They’re easy to use and have all the features small businesses need.

How Can Billing Tools Help Small Businesses?

Billing tools make invoicing easier and more accurate. From my experience, these tools save time and reduce mistakes, making my business run better.

Are There Free Billing Tools Available?

Yes, there are free billing tools like Zoho Invoice and Wave. These are perfect for small businesses just starting.

What Features Should I Look for in Billing Tools?

Look for features like automated invoicing, expense tracking, and customizable templates. These made managing my business much easier.

Conclusion

Choosing the right billing tool made a huge difference for my business. With the right features, I saved time and kept things organized. For me, Billed has worked well, but there are many good options out there. The key is to find what works best for you. I hope this helps you choose the right tool, and if you want to simplify your billing, I highly recommend Billed.